Recent studies have shown an increased level of incorrect house prices across the country over the last decade, with 31 percent of all properties having had their initial asking price cut in order to secure a sale. The most house price reductions occurred in Stockton on Tees, where 49 percent of market prices have been reduced before the property sold, followed by Aberdeen at 46 percent. The results would suggest North England and Scotland have the most incorrect house prices and reductions, with only three of the top 20 located in South England. London didn’t make it to the top 20, yet still experienced price cuts on 30 percent of properties over the last decade.

Recent studies have shown an increased level of incorrect house prices across the country over the last decade, with 31 percent of all properties having had their initial asking price cut in order to secure a sale. The most house price reductions occurred in Stockton on Tees, where 49 percent of market prices have been reduced before the property sold, followed by Aberdeen at 46 percent. The results would suggest North England and Scotland have the most incorrect house prices and reductions, with only three of the top 20 located in South England. London didn’t make it to the top 20, yet still experienced price cuts on 30 percent of properties over the last decade.

Prime real estate agent Wetherell, located in the esteemed neighbourhood of Mayfair, have been investigating the issue and found that the number of properties withdrawn from the local market in 2017 so far has surpassed the total number of sales. This year, there have been 26 property sales in Mayfair valued at approximately £83 million, yet 30 defeated vendors who have not seen success in selling their home have withdrawn from the market, at a total £114 million.

What has caused the increase in mispricing?

A number of reasons could be the cause of the mispricing of properties and subsequent withdrawals across the nation. Logically, this would be due to low demand and high stock. However, the UK property market is currently seeing high levels of demand, with low numbers of properties entering the market due to the economic uncertainty caused by Brexit.

Many agents are incorrectly pricing properties through lack of local market knowledge or as a means to secure a client, knowing that the price will need to be reduced in the months following the valuation. This approach is greatly influenced by the inflation of multiple agency instructions and the presence of online estate agencies, increasing competition with traditional agencies.

About 20 years ago, it was standard practice for a seller in Prime Central London to work with just one estate agent. That company would be responsible for pricing, marketing, and selling the property for the client. They would also be extremely experienced in sales trends, other properties, and buyer demand in the local market meaning pricing a property would typically be very accurate.

As sellers have been increasingly using multiple agents over the last ten years, it is not uncommon for the agent selling a property to be different to the agent who initially priced it. The influx of online estate agencies and property search websites have also led to vendors working with inexperienced agents for their local market and being assured of unrealistic sales prices to gain business.

This change in practice is apparent in 2016 property sales in Mayfair. Exactly 45 percent of sales were instructed by multiple agencies, and exactly 45 percent of sales were initially mispriced.

Peter Wetherell, CEO of Wetherell, said “Mispricing is deeply unhealthy and extremely bad for the good reputation of estate agency professionals who are experts in their local marketplaces.”

Property search website Zoopla found that property buyers around the UK are currently benefitting from an average discount of £25,000 due to the overpricing. This discount is even higher for buyers in London, at £57,323.

70 percent of residential property in Mayfair is currently mispriced

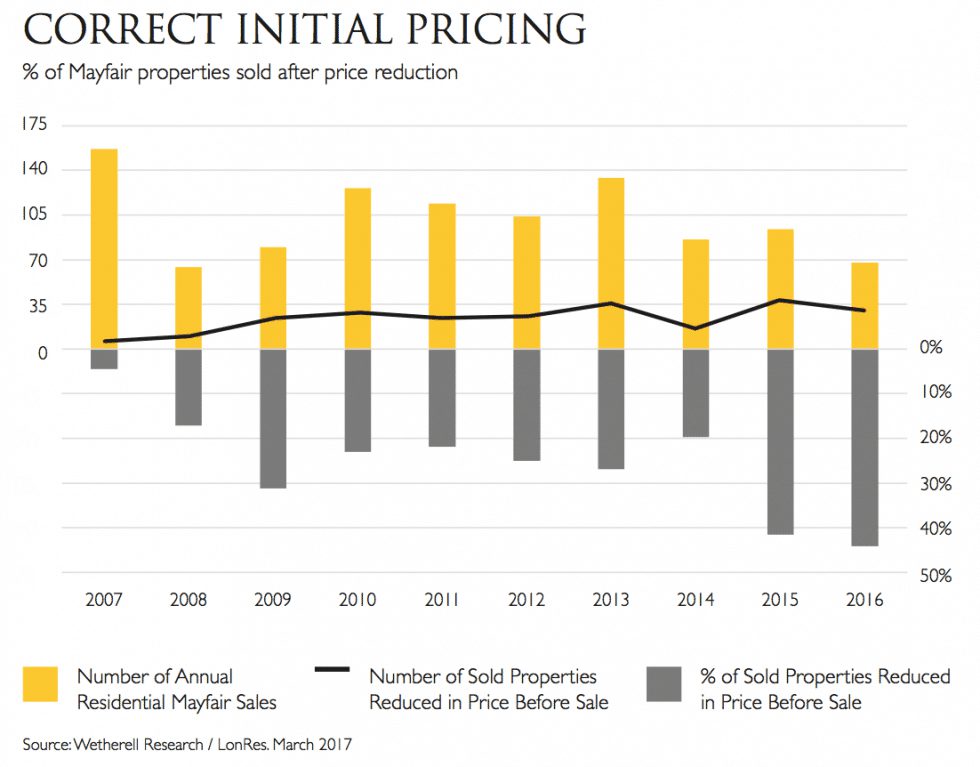

Wetherell reviewed LonRes sales data and local market intelligence and identified that 245 of the 1,047 residential property sales between the years 2007 and 2016 in Mayfair were initially mispriced and reduced before sold. Annual sales trends reveal that a property priced incorrectly takes around 14 months before selling. If priced correctly, a Mayfair property is expected to sell in about 3-6 months, and if undervalued it will usually sell in 1-2 weeks; although the latter is rare.

There were 160 properties on the Mayfair residential market in March 2017 and the average time on the market is ten months, suggesting that 70 percent are currently mispriced at a total value of over £1.1 billion, calculated on an average £4.6 million per unit. Of the remaining 30 percent, it is suspected that 25 percent are correctly priced, while 5 percent are underpriced. The 70 percent have caused slow sales, diminished trust in both buyers and sellers, and price decreases; all of which could have been avoided.

Robert Windsor, Development & Sales Director at Wetherell, says “It speaks volumes to us that 80% of the sales in Mayfair over 2015 and 2016 were handled by just two estate agents – Wetherell as the leading specialist boutique agent for Mayfair plus a leading corporate agent. Our local offices have highly experienced senior teams and a deep knowledge of the Mayfair marketplace. When Wetherell is instructed on a sole agency basis, or with another on a joint agency, the property is consistently priced correctly, marketed professionally and sold successfully.”

“However, so many times over the last five years, we have taken on properties which have previously been instructed with other agents or multiple agencies who have a far less knowledge of Mayfair or have slipped into a valuation “price war” in order to please the vendor and win the instruction, and the result has been mispricing and no sale. Eventually, these instructions have come back to Wetherell to resolve. It is interesting to see reports from portals of increasing price reductions – this does not mean that values have come down; merely that the properties have eventually reached their correct marketing price and are in line with local comparables.”

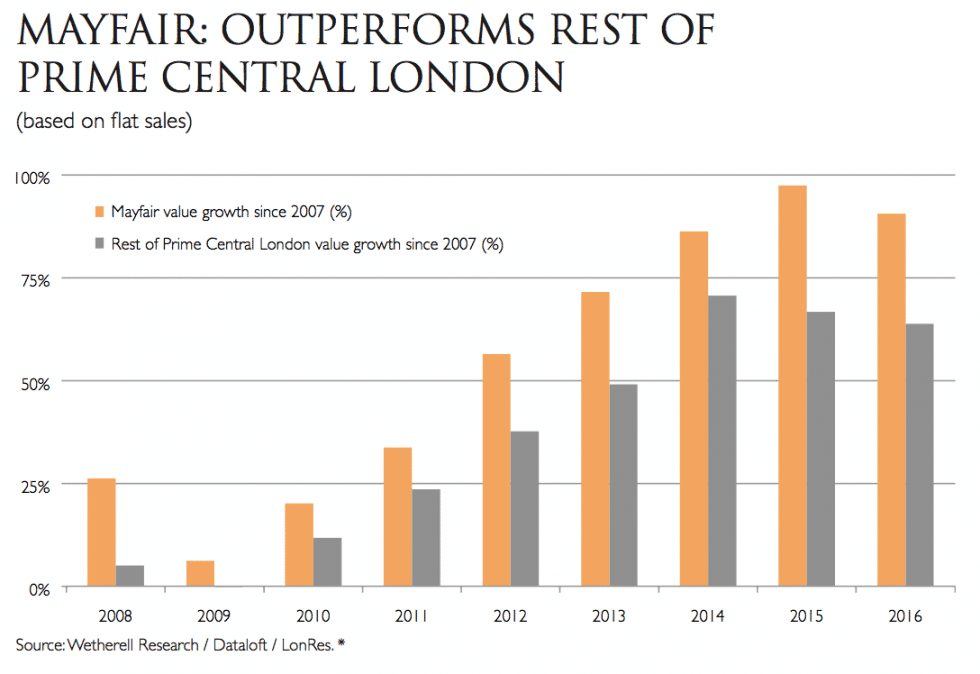

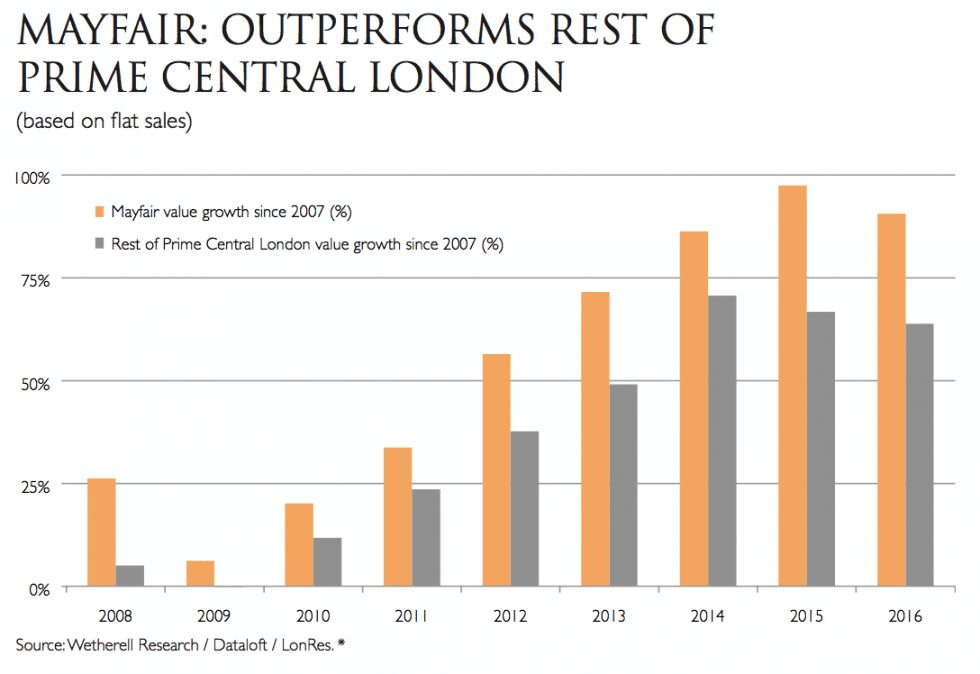

Mayfair has performed at a rate of 90 percent over the last ten years, compared with the rest of Prime Central London, which has performed at 70 percent. It is expected that Mayfair will continue its high performing streak and new residential developments in the pipeline for the next five years are likely to ensure Mayfair’s reclaiming of London’s number one residential spot is permanent.

Peter Wetherell, says “Don’t wait to buy in Mayfair. Just buy in Mayfair and wait – because the best is yet to come”.